The team at Bynder made three big changes to how they approach their tech ecosystem internally. For example: they decided to reposition their integrations as three types. Now its sales team can point prospects to the right integrations faster.

August 18, 2022

There are a million and one things you can do to improve the impact of your tech ecosystem, so how’s a partner manager to decide: Hire a team of devs focused on integrations, or work with external developers? Roll out two partner tiers, or four? Eat leftovers for lunch, or get takeout?

As a small team with existing partnerships to manage, it can be daunting to take a step back, evaluate, and make these tough choices. But making the right choices will improve all of your efforts and make integrations a top priority for your go-to-market (GTM) teams. Luckily, we spoke with someone who’s observed the impact that shaking up a partner program can have and has seen the shift in mindset of their GTM teams first-hand — The shake-up is worth it!

In 2020, the team at Bynder, a digital asset management (DAM) software company, shook up their tech partner program and doubled the size of their tech ecosystem from 13 integrations to 26 in just six months.

Before the shake-up…

Bynder’s tech and system integrator (SI) partners supported custom integration needs on an ad hoc basis, and the engagement would end shortly after launch.

Bynder’s sales team was overwhelmed by the complexity of their integrations, and conversations with prospects around integrations occurred post-sales.

Bynder’s developers dedicated time to building integrations that didn’t always satisfy their customers’ needs and had minimal quality assurance (QA) post-launch.

After the shake-up…

Bynder’s tech and SI partners support integration maintenance post-launch and engage in recurring GTM activities like co-marketing and co-selling.

Bynder’s sales team has a simplified repository of three integration types, enabling them to point prospects to the right internal stakeholders to discuss development and adoption prior to closing the deal.

Bynder has a full integrations team and product managers focused on integrations. They also work with subject matter experts (SMEs) to integrate with large systems (think: Supernodes like Salesforce).

“It was a major relief,” says Toni Aquino, Group Product Manager at Bynder. “[Previously], it was a lot of borrowed time for any discussions around integrations and working with partners.”

Aquino joined Bynder in 2015, when Bynder acquired Webdam. During the shake-up in 2020, Aquino transitioned from her role as a Solutions Engineer on the sales team to a Senior Product Manager of Integrations. Now, as Group Product Manager, she manages four product teams, including one focusing on integrations.

Aquino attributes the positive impact of the big shake-up to the following changes:

- Decision #1: They simplified their integrations into three types

- Decision #2: They rolled out three partner tiers for tech partners

- Decision #3: They began working with subject matter experts (SMEs) to partner with Supernodes like Salesforce

We spoke with Aquino about how her team made these tough decisions and the impact their choices had for internal and external stakeholders.

Decision #1: They simplified their integrations into three types

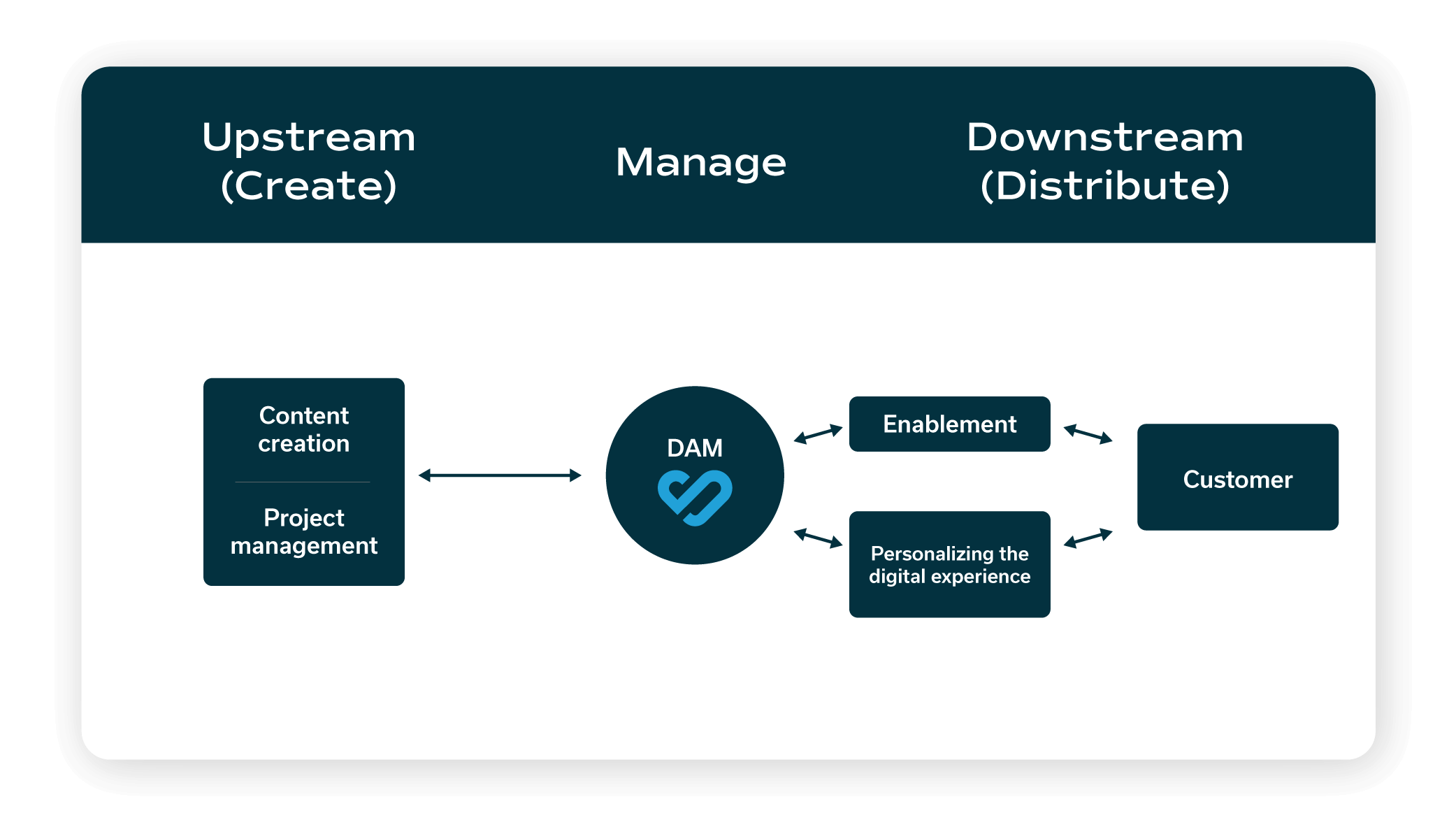

In 2020, Bynder’s team redefined the company’s positioning on integrations. Aquino decided to simplify their integrations into three types:

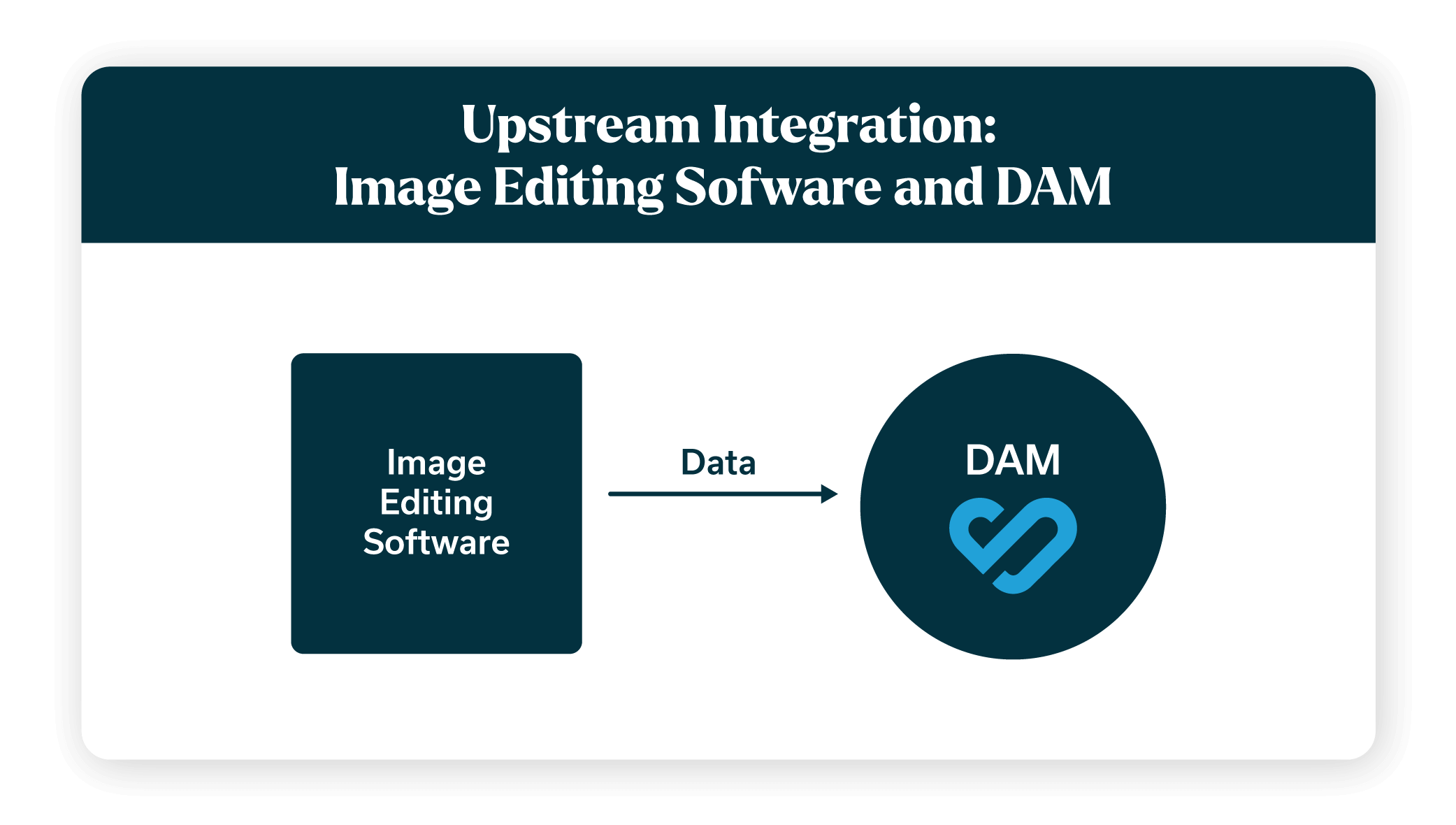

- Upstream, where data flows into the DAM.

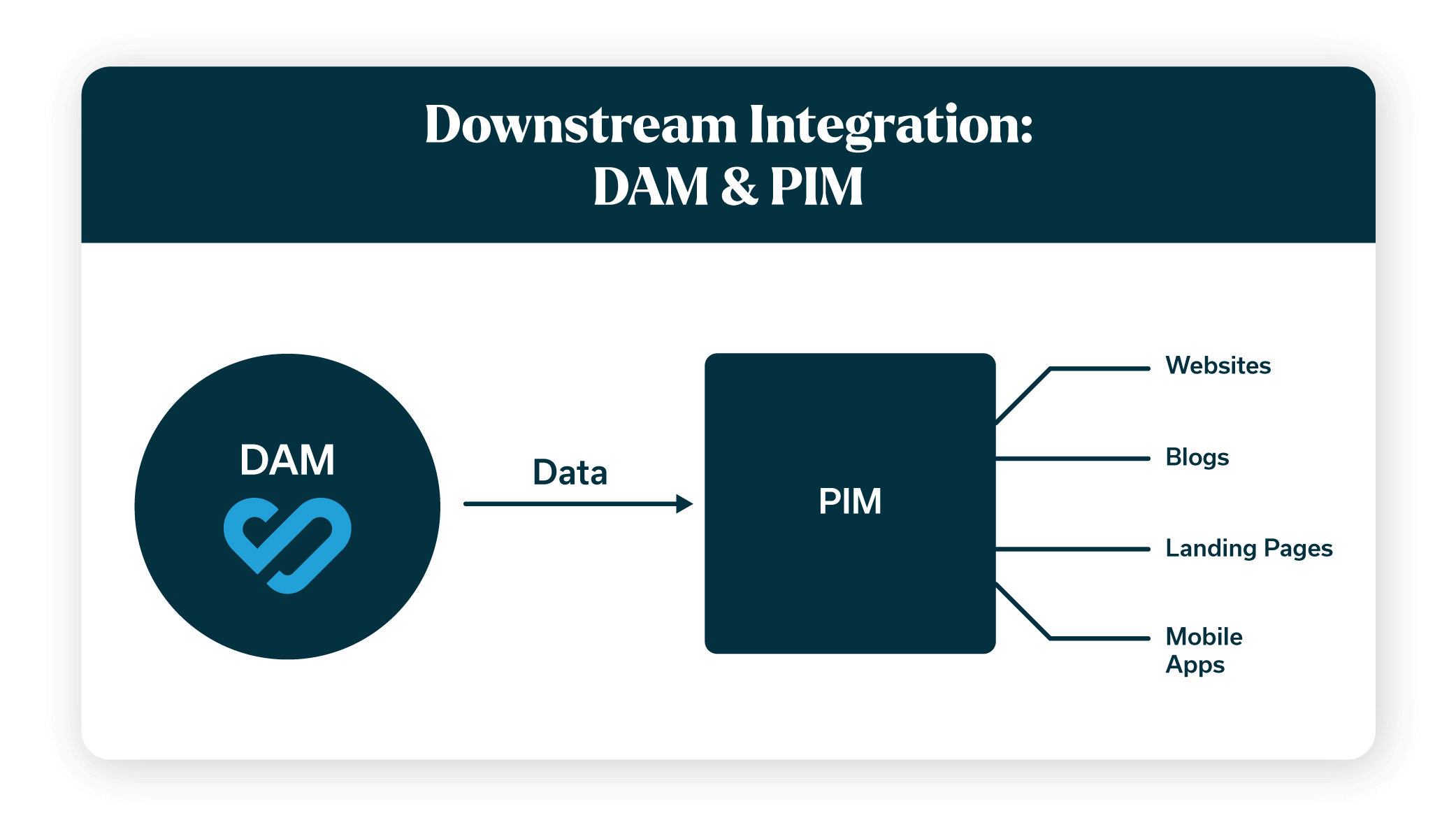

- Downstream, where data flows out of the DAM.

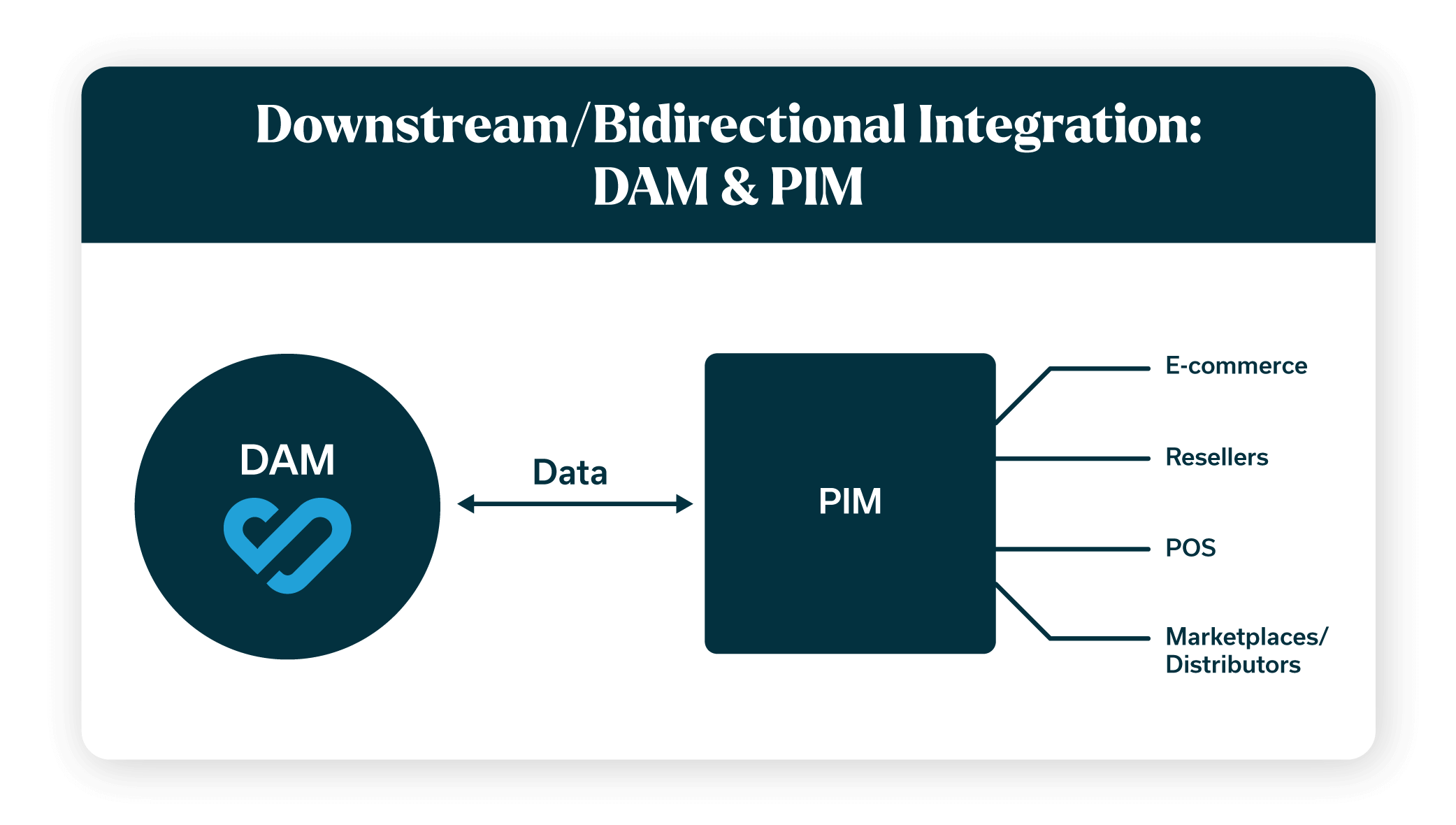

- Bidirectional, where data flows into and out of the DAM.

This simplification helped Bynder’s sales team better understand which types of integrations are most relevant to their prospects earlier in the sales conversation.

“The reason I simplified [our integrations] so much was because the idea of integrations was complex enough,” says Aquino.

The result: Bynder has observed an increase in partner attach rate on closed-won opportunities and an increase in the average selling price (ASP) for deals influenced by at least one tech partner.

How the repositioning influenced their sales team

Before the shake-up, Bynder’s sales team found the need to understand each integration’s use cases overwhelming. This led to only brief conversations about integrations during the sales conversation and, sometimes, the inability to meet a customer’s bespoke integration needs following onboarding.

“Our CS and sales team were trying to understand everything about every integration. It becomes overwhelming,” says Aquino.

Aquino has narrowed down her sales team’s choices around which integrations are relevant to a prospect from 20+ to only three. Once a sales rep understands if a prospect requires a downstream, an upstream, or a bidirectional integration, they then have limited choices for how to steer the conversation.

For example: If a prospect wants to move data out of the DAM, the sales rep knows the prospect needs a downstream integration — regardless of the tool the prospect needs to push data into. The sales rep can then present their prospects with two options:

- Leverage Bynder’s API

- Or use Bynder’s user interface (UI) feature

If a prospect wants to leverage Bynder’s API, the sales rep can point them to the developer portal and connect them with a solutions engineer to initiate next steps. If the prospect wants to leverage Bynder’s UI feature, the sales rep can point them to documentation on Bynder’s “Universal Compact View” page — which provides details on how developers can import assets from the DAM into other tools using their feature.

Their prospects get the answers they need faster, and Bynder’s team ensures they can meet their prospects’ integration needs post-sales — thus improving their overall customer satisfaction and retention.

“[In] its most basic form, we’re either getting assets from a third party and bringing it into the DAM, or we’re taking those and bringing it somewhere else.”

Aquino’s team has also developed visual aids showing how Bynder is a central part of their customers’ business processes. The below visuals show Bynder’s upstream, downstream, and bidirectional data flows and relevant use cases for each. These visuals help Bynder’s sales team better understand the types of integrations Bynder has and their product team understand where it’s best to invest resources in building.

“[The visual] always shows Bynder at the center,” says Aquino.

For example:

An upstream integration might entail creating digital assets, like product photos, for e-commerce sites using a content creation tool and bringing those assets into the DAM.

Then, a downstream integration might bring those photos into a product information management (PIM) system to manage and organize your product photos for publishing to an ecommerce site.

Bidirectionally, you can sync your product attributes, like product SKUs, between your PIM and your DAM and retrieve and analyze a record of all versions of the product photos in your DAM.

How the repositioning impacted their product and development teams

In addition to defining three types of integrations, Aquino and her team developed a story around how Bynder contributes to a “connected ecosystem” for their customers. The talking points include:

- DAM plays a critical role in running business processes at larger organizations — not an adjacent piece of the martech stack

- Therefore, once customers integrate, churning is unlikely

- Tech partners and integrations can open the door for sales, and once they do, these customers are likely to become long-term users

This story communicates the importance of Bynder’s tech ecosystem to all internal stakeholders. This resulting wide-spread understanding improved buy-in across Bynder’s teams and made integrations a top priority.

Following the changes around how Bynder communicates internally about their tech ecosystem, Bynder’s team hired its first product and integrations teams focused solely on integrations. They:

- Grew their product team for integrations from one to three

- Hired a full integrations team of seven developers

- Tripled their channel partnerships team (whose responsibilities include managing tech integrations and working with SI partners)

As they onboarded for the above roles, Bynder’s partnerships, product, and integrations team began to establish repeatable processes for scaling their tech ecosystem. They also began to roll out partner tiers to help determine which partners they would invest time and resources in working with and on which development and GTM activities.

Decision #2: They rolled out three partner tiers

In 2020, Bynder established three partner tiers:

- “Strategic” partners, which include long-term engagements with SI partners

- “Marketplace” partners, which include tech partners with integration listings and no GTM activities

- “Growth” partners, which include marketplace partners who can get additional benefits like strategic account mapping using Crossbeam, co-marketing, and co-selling

Aquino says that choosing the “Marketplace” and “Strategic” partner tiers was an easy choice as these two tiers aligned with the types of partners Bynder was working with already. They added the “Growth” tier into the mix to give the partnerships team an opportunity to invest in co-selling and co-marketing with tech partners who were equally willing to put in the work.

“The partnerships team wanted a path upwards [for partners],” says Aquino.

The result: Bynder has established clear expectations and internal indicators around integration launch timelines, including the build, launch, and GTM efforts with tech partners. They also have longer-term engagements with tech partners following the launch of an integration and involve them in co-selling motions with their SI partners.

Prior to the shake-up, Bynder’s tech partners would support custom development work on a customer-to-customer basis following the customer’s onboarding. However, there was no predictability around the development timeline from their tech partners, and there was little support following the integration’s launch. This led to Bynder’s developers struggling to meet their customers’ needs and also struggling to maintain the quality of their integrations with tech partners over time.

“There were no expectations of partners,” says Aquino. “They could get [an integration] done in a month, [or] we wouldn’t hear from them again for six months.”

She adds, “We were competing with ourselves. [Customers] were either breaking what we have or looking for an alternative,” says Aquino.

Bynder knew that by investing in the right kinds of integrations and long-term relationships with tech partners, their customers would be able to get the most value out of their platform while adapting it to suit their individual needs.

How partner tiers impacted their GTM teams

By implementing partner tiers, Bynder was able to keep their tech partners accountable for meeting integration development timelines and quality standards. They also established integration lifecycle “phases” that serve as indicators of each integration’s progress for their GTM teams’ visibility. These phases include:

- The “Tech Evaluation” phase

- The “Under Development” phase

- The “Technical Review” phase

- The “Product Ready” phase

- The “Product Demo” Phase

- The “Launch Ready” Phase

- And the “Released” Phase

Bynder’s GTM teams can reference Asana, a project management tool, to determine an integration’s progress in the early stages of evaluation and development. In the later stages, Bynder’s team publishes the integration’s current phase on Productboard, a product management platform, for customer-facing visibility.

Visibility into each integration’s progress enables Bynder’s internal GTM teams to identify the status of a particular integration and when they should complete corresponding GTM activities. For example: If an integration is in the “Product Demo” stage, this would send a signal to:

- The product marketing team to initiate sales enablement sessions

- The product training team to add the integration to their internal training program

- Customer experience (CX) to roll out integration messaging and documentation

This visibility also helps Bynder’s sales team communicate more accurately with prospects about the anticipated launch of a particular integration. For example: If a prospect expresses interest in a particular integration that’s currently in the “Tech Evaluation” phase or the “Under Development” phase, the sales rep can gather feedback from their prospect about what use cases they hope the integration will solve. They can then provide this information to the product team to prioritize these use cases in development and improve market fit for the minimal viable product (MVP) integration.

How partner tiers impacted their tech partners

Rather than contributing to ad hoc integration development, Bynder’s partners stick around to engage in GTM activities and co-selling. Specifically, partners in the “Growth” tier can commit more time and resources to the partnership to enjoy upward mobility.

As an incentive, Bynder offers these partners real-time account mapping with Crossbeam, opportunities to co-sell with their SI partners, and partner marketing opportunities, like co-hosting events, partner case studies, and joint blog posts.

“It’s more scalable to spend time with those [partners] that have categorized up than to spend time with everyone,” says Aquino.

For some “Growth” partners, Bynder can open the door for recurring co-selling opportunities with their SI partners. First, they demonstrate the value of their integration with a particular tech partner for a customer who overlaps with their SI partner. Then, Bynder introduces their tech partner to their SI partner to roll the integration out to more of their mutual customers.

This engagement among Bynder’s tech and SI partners provides their tech partners access to ecosystem qualified leads (EQLs) and helps their SI partners provide more value to their customers. With recurring opportunities, their tech and SI partners are incentivized to provide ongoing quality assurance (QA) and integration maintenance.

“We need them longer term,” says Aquino. “You need [partners] in the sales process. You need them in the support process. You have to hang onto that relationship.”

Tip: Use Crossbeam to map your “Customer” accounts to your SI partners’ “Customer” accounts. These are the customers you have in common with your SI partner.

Then, map those overlapping “Customer” accounts to your tech partner’s “Customer” accounts to see which customers you have in common with your tech partner and your SI partner. These are the customers who are using your software and your partner’s software and would likely benefit from adopting your integration with your tech partner.

Encourage integration adoption among these customers and help them achieve wins using the integration. Share these wins with your SI partner to illustrate the value the integration can provide to their customers. Then, introduce your SI and tech partner to initiate co-selling motions and adoption.

Decision #3: They began working with external subject matter experts (SMEs) to partner with Supernodes like Salesforce

Bynder began integrating with Supernodes (think: SaaS companies with 1,000s of partners), like Salesforce, SAP, and Adobe. These systems often require a high level of customization for customers, which would require more headcount and bandwidth from Bynder’s integrations team. Instead of investing in specialized developers for each Supernode, Bynder decided to work with subject matter experts (SMEs) through their SI partners.

“If we tried to build a team that knew every system out there, we’d have a team of at least 100 [engineers].”

She adds, “[These partnerships] have upleveled our customers.”

The result: Integrations are a regular part of the decision-making process for feature development. Influenced by its Salesforce partnership, Bynder launched its Digital Asset Transformation (DAT) feature and expanded to a new category outside of DAM. This enabled Bynder’s team to expand into the “content delivery” use case in addition to the DAM use case and helped Bynder access a new customer base — large enterprise customers.

“It was a major innovation for us and put us in a new category,” says Aquino.

To find the right SMEs to work with, Bynder went directly to their strategic tech partners for guidance. For example: They asked their partners at Salesforce which of their certified partners they recommend for integrating their systems.

Keep in mind: When working with an SI partner for custom development, you might experience channel conflict as you navigate grey areas, like when to bring in an SI’s SME into a particular project and when to bring in a tech partner’s developers instead. Aquino says navigating this type of channel conflict took trial and error, and they ultimately needed to decide which scenarios are owned by each type of partner and when. Make these tough decisions earlier (and have these tough conversations), so you don’t jeopardize the trust of either partnership.

Following Bynder’s expansion into content delivery, alignment of the partnerships team and the product team has improved. When the product team is considering building a new feature, they consult with the partnerships team to understand if there’s an integration use case. The partnerships team also consults the product team about particular integrations they’re scoping. They’ll discuss which use cases the integrations would solve without an open API and which use cases the integration would solve with an open API. More often than not, they’ll develop the new feature with an open API to support potential integration development.

“[Now,] when we develop new features, there’s consideration for developing an open API,” says Aquino. “The partnerships team became a support system for the product, and it’s improved how [our teams] think about future development.”

.jpg)

%20(1).jpg)

.png)

.jpg)

.png)

.jpg)

.jpg)

.webp)