Subscribe for Access

Identify and rank your most strategic accounts with partners through this 9-step framework, which combines ABM, ICP scoring, and account mapping.

When it comes to co-selling, more prospects isn’t always better.

(Did we just hear a gasp at the back of the room?)

“When you start to bring a lot of leads into the pipe, the conversion model starts to break,” says Forest Yule, Senior Director of Partner Development at customer engagement platform Airship. In other words, when you’re bringing new leads in for the sake of making quota, those leads aren’t always a good fit and could be wasting the time and resources of your sales and partnerships teams.

Yule says he ran into this challenge 12 months ago: His team was casting too wide a net early on when identifying prospect accounts for co-selling with partners. “We ended up having a lot of false starts,” says Yule.

To focus his team’s efforts and accelerate the right go-to-market (GTM) strategies with partners, Yule and his colleagues developed a framework for creating a shortlist of high-quality prospects for co-selling — prospects that have a higher likelihood of converting with the help of Airship’s partners and a greater potential impact on the business.

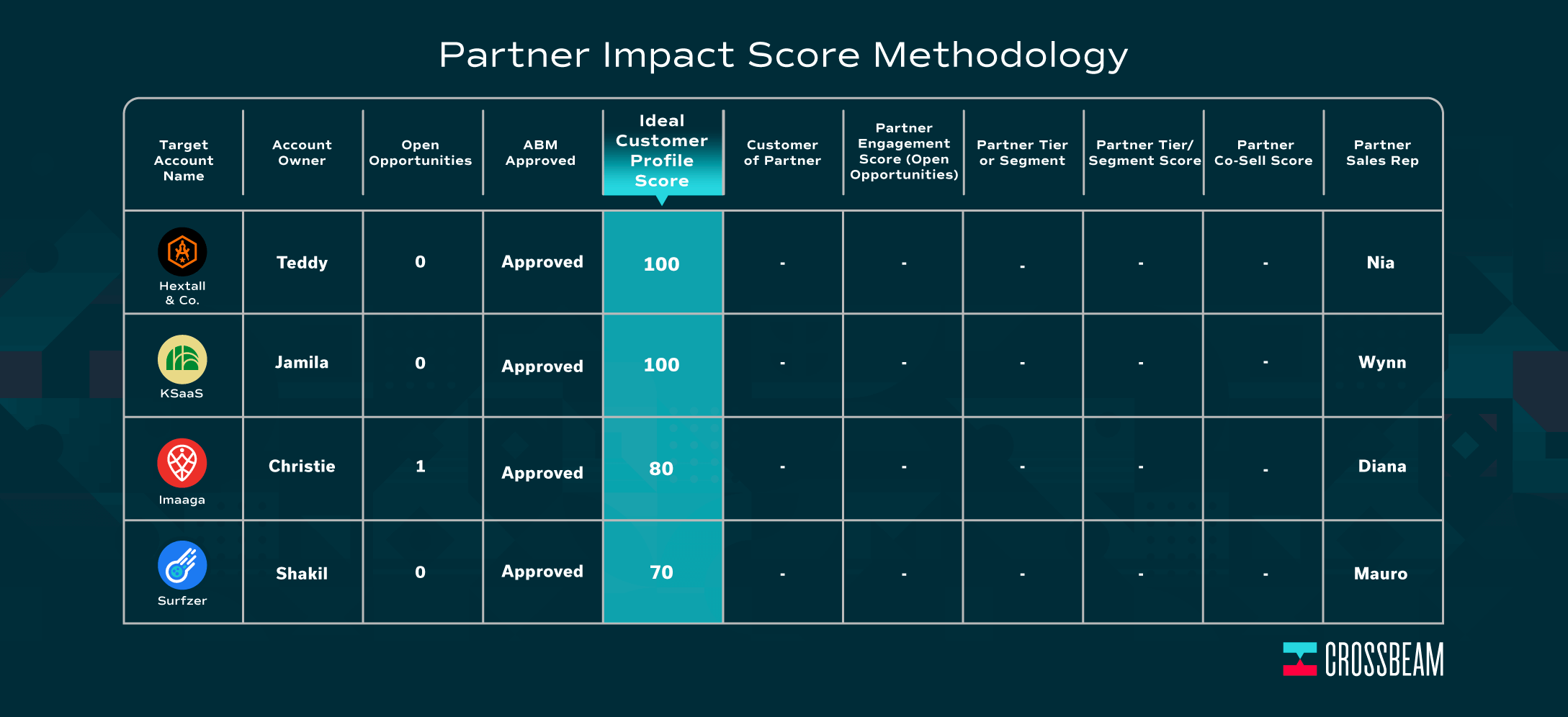

By following the nine steps of the “Partner Impact Score Methodology,” Yule and his team have cut their target list down from thousands of ABM-sourced prospects to a shortlist of strategic prospects per partner. And in just three months since implementing the “Partner Impact Score Methodology,” Airship has seen a significant increase in the number of opportunities qualified by its top partners.

The 9-step “partner impact score methodology”

Below, we’ll walk you through Airship’s “partner impact score methodology” so you can adopt each step as part of your company’s Ecosystem Ops and optimize your co-selling strategy with each of your partners.

To note: While explaining each step of the “partner impact score methodology” in this article, we’ll be walking you through four hypothetical prospect accounts (Surfzer, Hextall & Co, Imaaga, and KSaaS) for co-selling with a hypothetical partner, Vidzin. When you replicate this process on your own, you should use all of the prospect accounts you’re targeting to narrow down the most strategic accounts for co-selling with a given partner.

The 9 steps:

- Source a list of ABM-approved prospect accounts

- Assign each prospect account an Ideal Customer Profile (ICP) score

- Sort the prospect accounts from highest ICP score to lowest, identifying prospects that are at least a 70% match

- Map accounts with your partner to identify which of your prospects overlap with their customers (You can use Crossbeam for free to get this data with your partner in just minutes)

- Identify each prospect’s “partner engagement score” (the number of open opportunities your partner has with each account) (You can use Crossbeam to retrieve this data as well)

- Identify which of your partner’s tiers or segments each account fits into (optional)

- Identify each prospect account’s “partner co-sell score” (a cumulative score based on the results from Steps #4-6)

- Rank the prospect accounts according to their “partner co-sell scores”

- Scatter plot the prospect accounts using their “partner co-sell scores” and “ICP” scores in a four-quadrant matrix

What happens after: Initiating your co-selling motions and Go-To-Market (GTM) strategy

Let’s get started:

Step 1: Source a list of ABM-approved accounts

At this point, Airship retrieves a target list of thousands of prospect accounts from its account-based marketing (ABM) platform. These are the accounts that qualify for ABM spend.

You can use an ABM platform like RollWorks, 6sense, or Terminus (to name a few) to identify your ABM-approved prospect accounts.

If you don’t have an ABM platform, it’s likely because you’re still building up your pipeline. Consider using all of your prospects for this step. Or you can timebox prospects (aka “prospects sourced in the last six months”).

To Note: Checking if an account is ABM-approved before assigning an ideal customer profile (ICP) score (Step #2) helps to narrow down the prospects that qualify for ABM spend. This way, when you get to the next step, you’re not spending time on prospect accounts with a high ICP score that are not ABM-approved.

Step 2: Assign each prospect account an Ideal Customer Profile (ICP) score

Airship layers ideal customer profile (ICP) data on top of ABM data to surface, rank, and narrow down a list of their most strategic co-selling opportunities.

To assign an ICP score, each of Airship’s ABM-approved, target prospect accounts receives a score between 0-100.

Airship uses a set of 100 data points to score their prospects. You could use one data point or dozens. The important part: use factors that make sense for your business. The way in which you weight certain attributes to determine your ICP scoring will depend on your company’s business objectives.

Airship’s ICP includes B2C brands with strong mobile use cases, specifically where a mobile app is a key engagement channel for its customers. Typically, Airship looks for companies in retail, travel and hospitality, media and entertainment, financial services, and technology.

Step 3: Sort the prospect accounts from highest ICP score to lowest, identifying prospects that are at least a 70% match

Airship then sorts the prospect accounts according to their ICP scores from highest to lowest. The accounts that receive a score of 70 or greater (a 70% match or greater) make it on to the next round. To replicate this step on your own, you’ll need to determine which percentile of ICPs you’d like to graduate to the next round (in Airship’s case, they focus on the top thirtieth percentile).

This narrows the list down to a dramatically more manageable number of prospects that should be close to the number you can action in a single quarter. This shortlist of prospects is what we’ll be working with for the rest of this process.

Step #4: Map accounts with your partner to identify which of your prospects overlap with their customers

Here’s where your partner comes in. Airship’s team maps accounts with its partner to see which accounts on their shortlist of prospects overlap with its partner’s customer list.

You can use a partner ecosystem platform (PEP) like Crossbeam to discover how many and exactly which accounts you have overlapping with each of your partners. Simply upload your shortlist of prospect accounts, and have your partner upload their customer list (tip: you and your partner can choose which accounts to reveal to one another at any time).

For each prospect account that overlaps with its partner’s customer list, Airship gives the account a score of “1.” For each account that is not a customer of its partner, Airship gives the account a score of “0.”

In the example below, we’ve mapped accounts with hypothetical partner Vidzin and have discovered that Hextall & Co, KSaaS, and Surfzer are each existing customers of Vidzin. Therefore, each of these prospects receives a score of “1” in the “Customer of Partner” column. Imaaga is not a customer of Vidzin, so Imaaga receives a score of “0”.

To note: In Steps #4-7, we’re no longer narrowing the list down but rather assigning each account on your prospects shortlist a set of numbers that will factor into each prospect’s “partner co-sell score” (Step #7).

Step 5: Identify each prospect’s “partner engagement score” (the number of open opportunities your partner has with each account)

For each of your prospect accounts that received a score of “1” in the previous step (they’re a customer of your partner), determine the amount of additional open opportunities your partner has with the account. To clarify, the account may already be a customer of your partner, but your partner can have additional open opportunities for the account while cross-selling to other departments in the organization or to the its global branches.

For example, your partner may have Amazon Web Services (AWS) São Paolo as a customer but may be looking to cross-sell to a number of its other global branches — like AWS Frankfurt or AWS London. Additionally, your partner may already have AWS’ marketing team as a customer, and they may be in ongoing discussions to bring AWS’ IT, sales, and customer success teams on board as customers. The higher the number of open opportunities your partner has with the account, the higher the level of engagement they have with that account. Yule’s team calls this the “partner engagement score.”

In the example with AWS, various members of your partner’s team likely have connections to AWS’ Chief Marketing Officer (CMO), VP of Sales, Chief Technology Officer (CTO), and so on. These are all possible introductions for you — and the higher the engagement, the more influence your partner may have in your favor.

To discover this data through Crossbeam, use your list of target prospect accounts that meet the criteria of overlapping with your partner’s customer list (you retrieved this data in Step #4), and map those accounts with your partner’s opportunities list. In order to see all of the open opportunities your partner has with the account, your partner must share opportunity-level data with you in Crossbeam. If your partner only shows the opportunity account name, you will not see the number of open opportunities the partner has with the account.

The greater the number of open opportunities your partner has with the account, the better the “partner engagement score.”

For instance, if a partner has 15 open opportunities with a given account, the partner’s team likely has existing connections to the c-suite and other stakeholders at the organization. If that’s the case, the partner can help facilitate an introduction for you or your sales reps to various stakeholders that you would otherwise have difficulty accessing alone.

This could make all the difference between having a sales conversation with the right people in a matter of days rather than months down the line.

In the example below with hypothetical partner Vidzin, your prospect account Hextall & Co. is an existing customer of Vidzin. Vidzin is also cross-selling to other departments at Hextall & Co. and has 25 open opportunities with the account.

Step 6: Identify which of your partner’s tiers or segments each account fits into (optional)

If your partner’s customers are segmented by “select accounts,” “corporate accounts,” and “enterprise accounts,” for instance, notate which segment each account fits into.

To determine the “segment” or “tier” score, assign each existing segment or tier a number with the highest number corresponding to the most strategic partner segment or tier. In the below example, your hypothetical partner Vidzin segments their accounts by “Platinum,” “Gold,” and “Silver.” We’ve assigned the “Partner Tier / Segment Scores” for each prospect like so:

- “Platinum” has been assigned the score of “3”

- “Gold” has been assigned the score of “2”

- “Silver” has been assigned the score of “1”

This one takes a little bit of manual work, but partner tier is another proxy for how much a partner can help you with the prospect account.

Airship knows that the prospect accounts existing in its partner’s top tier likely have the most resources and team members dedicated to them. These are the accounts a partner is most likely to have the:

- Most connections with stakeholders at the account

- Most influence on the account

Step 7: Identify each prospect account’s “partner co-sell score”

Yule has assigned specific weighting to the results from Steps #4-7 so that when adding the results together, the criteria that is most important to Airship plays into the equation most heavily. By weighting each factor differently, Yule is able to test assumptions and iterate on Airship’s custom formula.

Let’s look at the row for the hypothetical prospect account “KSaaS,” which sits in the second row of our sample chart.

- Number representing whether or not prospect account KSaaS is a customer of your partner Vidzin = 1

- Number representing the “partner engagement score” for KSaaS (or the amount of open opportunities Vidzin has with prospect account KSaaS) = 2

- Number representing which of partner Vidzin’s segments or tiers your prospect account KSaaS exists in = 1

This is the part that you’ll need to customize, iterate on, and determine what works best for your company. Let’s say you consider the “partner engagement score” as extremely important and the “partner’s segment or tier” least important. You then decide to weight each factor accordingly:

- Weight 35% (Number representing whether or not the prospect account (KSaaS) is a customer of your partner (Vidzin) = 1)

- Weight 45% (Number representing the “partner engagement score” for the prospect account (KSaaS) aka the amount of open opportunities the partner (Vidzin) has with prospect account = 2)

- Weight 20% (Number representing which of your partner’s (Vidzin’s) segments or tiers your prospect account (KSaaS) exists in = 1)

With this weighting in place, the weighted numbers look like this:

- 1(.35) = .35

- 2(.45) = .9

- 1(.20) = .20

And the formula is:

1(.35) + 2(.45) + 1(.20) = “partner co-sell score” for prospect account KSaaS

Add the results together, and you get a “partner co-sell score” of 1.45 for prospect account KSaaS with hypothetical partner Vidzin.

Calculate the “partner co-sell score” for each of your prospect accounts using the weighting system you’ve established.

Step 8: Rank the prospect accounts according to their “partner co-sell scores”

Sort the “partner co-sell scores” numerically from highest to lowest. The prospect accounts with the highest “partner co-sell score” and the highest “ICP score” will play critical roles in Step #9. Keep these numbers ready!

Step 9: Scatter plot the prospect accounts using their “partner co-sell scores” and “ICP” scores in a four-quadrant matrix

Now it’s time to scatter plot your shortlist of prospect accounts in a four-quadrant matrix. Remember that ICP score you created in Step #2? Let’s bring it back.

In the “New Business Co-Sell Targets” matrix in this section, the y-axis represents the prospect accounts’ ICP scores from lowest (bottom of the y-axis) to highest (top of the y-axis). The x-axis represents the prospect accounts’ “partner co-sell scores” from lowest (left side of the x-axis) to highest (right side of the x-axis).

The prospect accounts with the highest ICP scores and highest “partner co-sell scores” fit into the upper right-hand quadrant. Airship looks to the upper right-hand quadrant to identify the best opportunities for co-selling with a given partner (These are the accounts with the highest “partner impact score”).

In the example below with hypothetical partner Vidzin, prospect account Imaaga has a “partner co-sell score” of 3.16 and an ICP score of 80. This account belongs in the bottom left-hand quadrant slightly below the middle of the y-axis (since its ICP score is 80, slightly below the half-way mark of Airship’s 70-100 ICP range, and its “partner co-sell score” is relatively low). Meanwhile, Hextall & Co. belongs in the upper right-hand quadrant since it has a high “partner co-sell score” (12.2) and high ICP score (100).

Yule suggests actioning each quadrant of the matrix like so:

- Upper right-hand quadrant (High ICP score AND High partner co-sell score aka High Partner Impact Score!) — These are the prospects you should request introductions into from your partner and/or develop a GTM strategy for co-selling to these accounts with your partner. Prioritize these prospects with your partner first and foremost!

- Upper left-hand quadrant (High ICP score, Low partner co-sell score) — Consider ABM or direct outreach through your SDRs for these prospects. Since there is not a high “partner co-sell score,” do not engage your partner in brokering an introduction. Alternatively, if you have an integration with your partner in which your product could add value for the prospect, you and your partner could target the prospect together. For your top partners, your partner’s brand reputation and your combined solution could help open the doors to the prospect.

- Lower right-hand quadrant (High partner co-sell score, Low ICP score) — These prospects may require more effort from your team considering the accounts do not align as heavily to your ICP; however, you should engage your partners in accessing these accounts and accelerating the conversation. Yule suggests there may be unsuspecting deals lurking in this quadrant.

- Lower left-hand quadrant (Low partner co-sell score, Low ICP score) — De-prioritize these prospect accounts — instead focusing on the other three quadrants!

By organizing the prospect accounts in a matrix, Airship’s team now has a highly targeted list for co-selling with a given partner. This means that:

- Airship’s partnerships team can work more efficiently with its internal sellers on targeting the right prospect accounts

- The sellers from Airship’s team and from its partner’s team can work together more efficiently on co-selling to prospect accounts that are likely to drive the biggest business impact

- Airship and its partners’ teams are less likely to lead co-selling motions with a poor conversion rate or a low business impact

What happens after: Initiating your co-selling motions and Go-To-Market (GTM) strategy

Identifying your most strategic prospect accounts with partners means nothing without a co-selling motion and/or GTM strategy behind it.

With a shortlist of target prospect accounts with each partner, Airship is able to dedicate the time of its partnerships and sales teams more purposefully. In addition to asking partners to broker introductions for its sales team, the “partner impact methodology” allows Airship’s team to think strategically about the year ahead. With a more manageable shortlist of strategic target accounts, Airship can coordinate a strategic event series, webinar series, and other co-marketing initiatives for getting their partners’ support in:

- Facilitating meaningful introductions (think: in person)

- Vouching for your product to the prospect on your behalf

- And other other forms of partner influence

Additionally, the “partner impact score methodology” can help you identify the types of accounts you and your partner have in common. For example, if the majority of the prospects on your final shortlist are from the e-commerce space, you should collaborate with your partner on a strategy for engaging that particular space. Consider co-hosting a webinar revealing insights relevant to e-commerce professionals. Your GTM strategy could open the door to additional opportunities similar to the results from the “partner impact score methodology.”

“It’s about reducing that signal to noise ratio so that all the conversations we’re in align very specifically to that partner impact score,” says Yule.

—