In this article you will learn:

- How to use data to evaluate and scope your partners.

- How to use, track, and measure the efficiency of your partners.

- How to identify if a partnership is worth reactivating.

- The top 3 tips for sharing Nearbound data with your teams and partners.

Gone are the days when good feelings and your gut were enough to decide on a partnership. You can’t go to your CRO and say, “I think we should partner with X company because I have a good feeling about the relationship.”

You have to present facts about the value of the partnership. Facts like:

- The partner will generate X amount of revenue.

- We have X number of common customers with this partner.

- X percent of our prospects are customers of the partner.

You need to show how each partner will help your company get closer to your Annual Recurring Revenue (ARR). This requires pulling data from the right sources.

Data through the partnership cycle

Leveraging data is key to unlocking valuable insights and optimizing partnerships.

It’s high time for companies to reflect on how they are utilizing data to effectively manage their partners on a day-to-day basis. Data plays a vital role throughout the entire partnership cycle and helps you build trust not only with your partners but with your teams, too.

The question here is: How do you identify the most important data point during each stage of your partnership among all the data points that can be tracked?

We recently sat down with Negar Nikaeein, Senior Channel Partner Manager, Strategic Alliances at PartnerStack, and Chris Gorsuch, Senior Partnerships Manager at Workable, in one of our Nearbound at Work sessions to lay out the 3 key moments in the partnership cycle where data truly shines as a powerful ally, enabling companies to demonstrate why a particular partnership is essential.

Let’s jump into these 3 moments together:

Evaluate and Scope a New Partner

Selecting a partnership just because you have common goals is not enough; you need data to support how you’re going to reach those goals. It’s also the only way you’re going to get buy-in from your team.

Keep in mind that there are two types of data, qualitative and quantitative. You need both to identify if that new partnership is worth investing in.

Here are some questions you can ask to gather relevant quantitative data to evaluate and scope a new partner:

- What is their internal team size?

- What is their account mapping stage?

- Do you have a large set of overlapping customers to justify an integration or potential for sharing mutual referrals?

As for qualitative data, here are some variables you need to consider:

- Quality of customer overlaps. Maybe you only have 20 common customers, but all of them are high-qualified enterprise accounts. If that’s the case, it might be worth starting that conversation.

- ICP alignment. To identify if your partner’s ICP aligns with yours you should consider data like demographic, psychographic, technographic, purchase behavior, and reviews.

- Their willingness and capability to get the work done. Do they have the resources and capacity to achieve mutual goals?

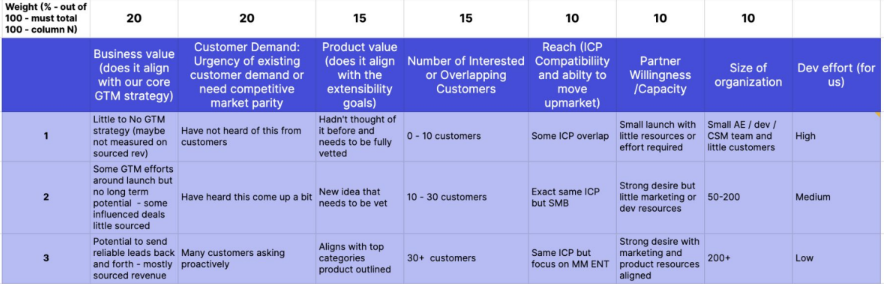

Use PartnerStack and Hightouch’s Tech Partner Prioritization Matrix as part of your evaluation and scoping process. Put together the data that shows the value of that new partner and all of the resources you might need to achieve that mutual goal.

Launching your partnership

It’s normal that, after launching a partnership, you still need to present some facts to prove the value of your partner. Use data you obtain from success indicators to state where your partnership is going.

Here are two different types of data that will help you pass the test:

1. Leading indicators. These fall within Account Mapping. You can use Reveal to help you mix qualitative and quantitative data.

For example: in the first couple of months, you have 20 open opportunities that are existing long-term customers of your partner, and their Annual Contract Value (ACV) is high. So, it will make sense to co-sell and get their support to close your open opportunities.

To make this happen, look for low-hanging fruit within your Nearbound data:

- Common prospects

- Contract values

- Who are the customers of your partner?

- Where you might be able to get support on these opportunities?

- Overlap on open opportunities

2. Lagging indicators. These will help you measure the current performance of your partnership. Focus on:

- Nearbound pipeline (partner attached open opportunities)

- Number of registered deals

- Partner-sourced leads

- Nearbound revenue

Partner management

You’ve worked hard to get the partnership set up. Don’t throw it all to the wayside by being reactive with leads or requests that your partner is sending. Here’s how you can be proactive with your partner to prove value and build trust:

Audit.

Every quarter, complete a full audit of your partner within PartnerStack and Salesforce. Ask yourself these questions:

- Which partners haven’t been engaged for a while?

- Which ones have been highly engaged?

To get the answers, use revenue data, link activity, leads, and/or deals submitted.

Once you have that data, create a plan to reactive those partners that haven’t been engaged, and identify those key motions that can help you drive more results from engaged partners.

If one of your partners is not driving those mutual KPIs, but you still want to work with them, you need to find adequate data that you can use internally to defend your case.

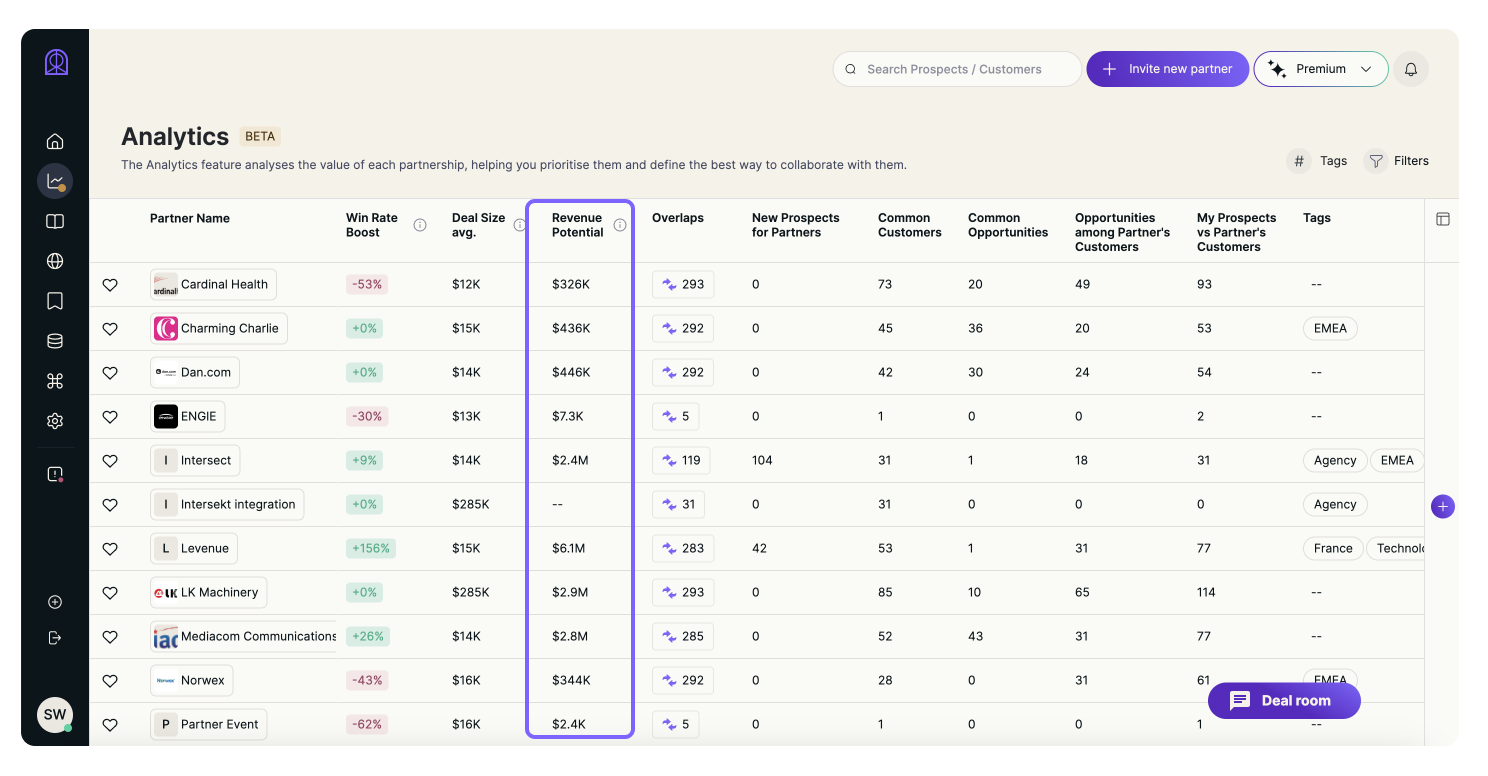

Here’s what you can do: jump into Reveal and identify their revenue potential. If it’s high, that’s all you need to get the buy-in.

Who doesn’t love more revenue in their pipeline?

Now you just need to identify the strategies to reactivate that partner. Here are some best practices for doing so from PartnerStack:

- Gain a better understanding of your partner’s journey

- Build strong partner enablement

- Outline the partner journey

- Run an activation campaign for new and old partners

- Market updates to your partner program

Learn more tips and tricks on how to spot inactive partners, why they go inactive, and how to reactivate them here.

Don’t keep data hostage

None of the given tips would be possible if you’re only focusing on sourcing data. You also need to share it.

Enabling your teams and partners is essential to an engaged and successful relationship. In partnerships, there’s no “get” without a “give”. So, here’s a systematic way to help your partner and your team understand and reciprocate the power of data:

- Win-win weekly meetings. Have weekly one-to-one meetings with your GTM team (AEs, Partner Managers, CSM) and partners, and use that time to build reciprocity. Ask your team/partner what opportunities are they working on right now, if those opportunities are connected with existing customers, and where can you help them. Account Map together and track the progress.

- Track all your outbound requests for intel or intros to help support new opportunities. Keep an eye on the pipeline and overlaps to identify where you can reciprocate with either intel or intros. Try to have at least the same amount of intros provided and requested.

- Establish a dedicated channel to provide intel. You have to bring the intel into the flows that your team and partners are already working in, be it either Slack, Salesforce, or HubSpot.

Lastly, always keep in mind the key intel that either you or your Customer Success team can provide to that partner that has just opened pipeline with one of your customers. Here are a couple of tips on how to do it:

Data-driven partnerships

By leveraging data throughout the partnership cycle, companies can make informed decisions, drive revenue, and foster successful and mutually beneficial partnerships. Data is the ally that enables your companies to unlock valuable insights and optimize your partnerships.

Modern partnerships are data-driven.

Transform your partnerships into valuable revenue generators. We have a team ready to guide you through the data-leveraging process.

Learn how to build data-driven partnerships and drive 2x more revenue.