This post is part of the “Tech Ecosystem Maturity” series, exploring the 30+ criteria of Crossbeam’s Tech Ecosystem Maturity Diagnostic. The diagnostic helps you understand how your partner program stacks up against others in the B2B SaaS industry, what you’re doing well, and how you can advance to the next level of maturity. To learn more and take the tech ecosystem maturity diagnostic, click here. Read the rest of the Tech Ecosystem Maturity series here.

As the tech partner world continues to expand, SaaS companies have an increasing number of partnership options. Additionally, you have a limited amount of time to invest in pitching potential new partners. So how do you get your program to stand out from that of your peers while narrowing down your scope of focus to help you secure the partnerships you want?

Enter our Tech Ecosystem Maturity Diagnostic, a survey we created to measure the reach, success rate, and efficiency of partner programs. At the time of writing, there have been 201 diagnostic submissions from 184 organizations.

Respondents are asked a series of 14 questions about specific parts of their program, and each answer is used to rank how mature that particular aspect of the program is. While this data is used for respondents to discover their averaged-out level of maturity, it also gives us a birds-eye view of the state of tech partner programs in general. As a result, we’ve identified some areas where a little investment would go a long way.

For example, if a large percentage of respondents fall into higher maturity categories for, say, co-selling, then we know there’s an industry-wide focus on co-selling. Alternatively, we can see where very few respondents are ranking as highly mature, indicating underinvestment in those categories. Those categories:

This underinvestment is an opportunity for savvy partner professionals to offer something unique to stand out and score new partnerships. More partnerships equals an expanded ecosystem, potentially opening the door for you to ask for more resources and headcount.

Public-facing integration directories

6% of respondents have the most developed form of integration directory: self-service, and public-facing.

A public-facing, self-service directory of integrations can showcase the breadth of your integration availability to potential new partners. It can make you an easier partner to work with by letting your current partners update their own listings as their integrations are upgraded, giving them control over the messaging and accuracy of their directory listing.

Handing over the reins to your partners is also good for your team. The time you normally spend checking in about integration updates for your directory can be spent on your other pursuits.

Read up on how you can build your integration directory:

Integration impact on churn and growth

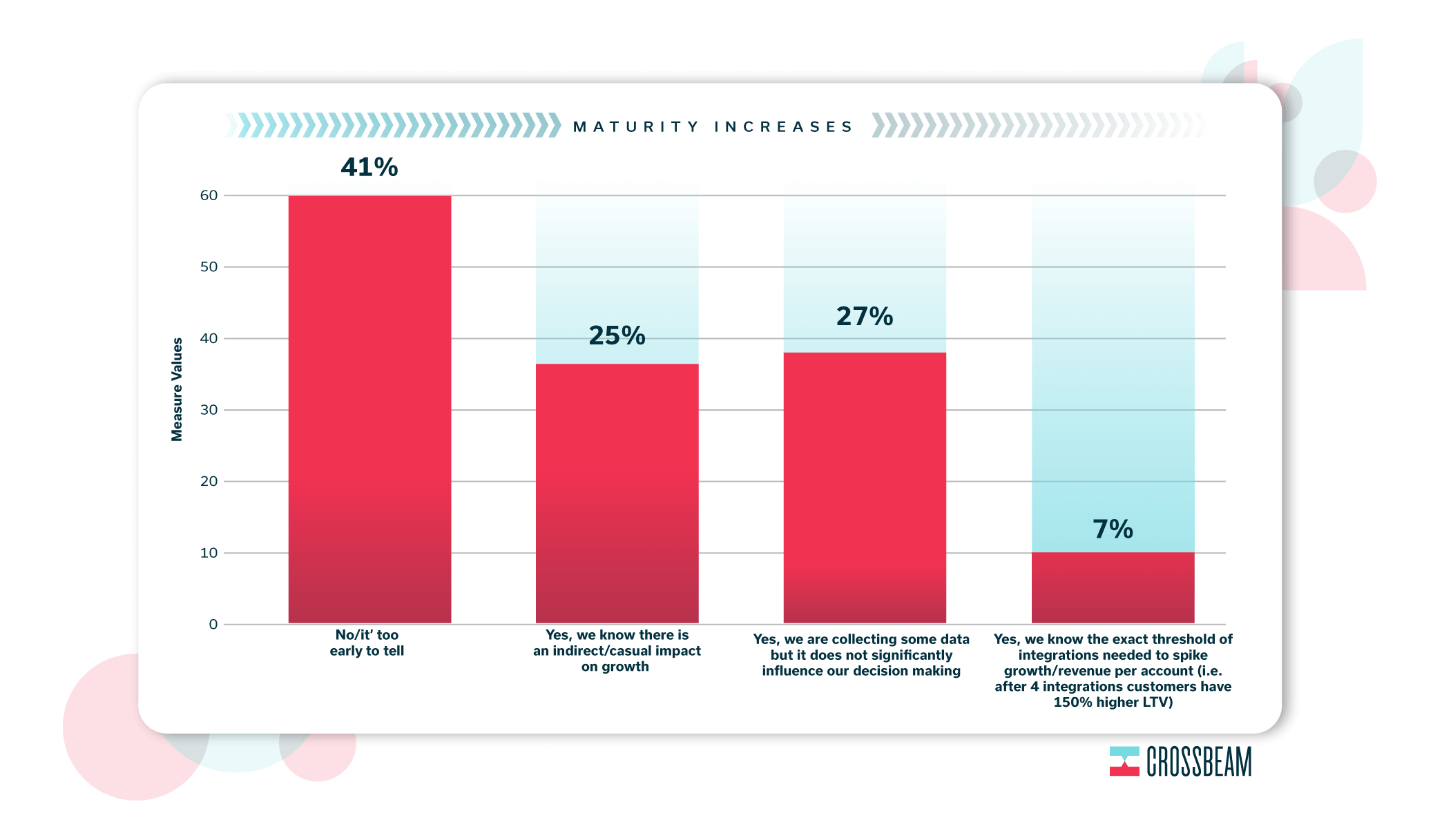

8% of respondents track churn and have scalable programs involving partners in strategic planning for renewals, hitting the highest level of development. Additionally, 7% of respondents know the exact threshold of integrations needed to spike growth revenue per account (i.e. after 4 integrations customers have 150% higher LTV).

Tracking the impact integrations have on your companies growth and churn can make you more appealing to new partners by showcasing how frequently customers find value in your integrations.

Tracking the impact your integrations have can also potentially bring more resources and headcount to your team. According to our diagnostic results, those who measure the impact that integrations have on churn are three times more likely to have both a budget and dedicated hours for integrations and input into business strategy.

Lay the groundwork for tracking retention, growth, and churn:

- Track your partners’ subscription status: Tracking your partners’ data (or second-party data) will let you measure growth and churn through visibility into who’s paying for your product, who stops, when they stop and why.

- Track how many integrations your customers are using: Then, analyze whether or not those with higher numbers of integrations have a lower rate of churn (and a higher rate of growth).

“Better together” messaging for integration partners

9% of diagnostic respondents are providing their partners with tools and templates to build “better together” messaging.

Better together messaging is the language you and your partner use to tell the story of the integration you created together. It is used to show both customers and internal stakeholders why the integration is valuable to them, hopefully getting both you and your partner the attribution you deserve.

Having your “better together” messaging templated out can save a partner time once they partner with you. This can be especially useful for those partners with smaller teams.

Strengthen (or start) “better together” messaging:

- Establish specific language for your verticles or categories of partners. If you see consistent success in messaging to a particular vertical of partners, don’t be afraid to template it out for future use. This can save you time on writing while leading with already tested language.

- Share easy-to-use social media templates with your partner to promote your integration with customers. Doing so can make sure your approved messaging is in front of both your and your partner’s audiences (and might score you some points with the marketing department).

- For partners who are unsure about the value of “better together” messaging, highlight previous success stories. Having proof of “better together” messaging as a successful marketing tactic can help convince your partners that building your own is worth it while giving them something to get buy-in from their team as well.

- Create a pitch slide deck for you and your partners to showcase your integration to internal stakeholders. Sit down with your partner and personalize the template to your integration so you are on the same page while pitching your internal stakeholders.

Partner Ecosystem Platform use

54% of diagnostic participants use a PEP. However, only 9% are using their PEP in the most developed way, using partner ecosystem data for reporting and data enrichment in other parts of their tech stack.

A Partner Ecosystem Platform (or PEP) can be a powerful tool for tech partner professionals, with account mapping that helps you identify the number of overlapping customers you have with a potential partner. This helps you to decide whether an integration is worth building. PEPs can also help you save your partners time and effort by revealing if certain partnership motions are working and which shouldn’t be replicated.

Want to purchase a PEP and level up your maturity? Here are some questions you should ask before signing any purchase contract:

- How does your software help me land more deals?

- What security controls are in place to keep my data and the data of my partners secure?

- How do your software and your company operate within GDPR or CCPA regulations?

- What steps are required to connect data sources to your software?

- Can you share the features that best allow my partners and sales team to take action on shared data with partners?

This is a test comment.

This is a longer test comment to see how this looks if the person decides to ramble a bit. So they're rambling and rambling and then they even lorem ipsum.